November 2020 Voter Guide – Statewide

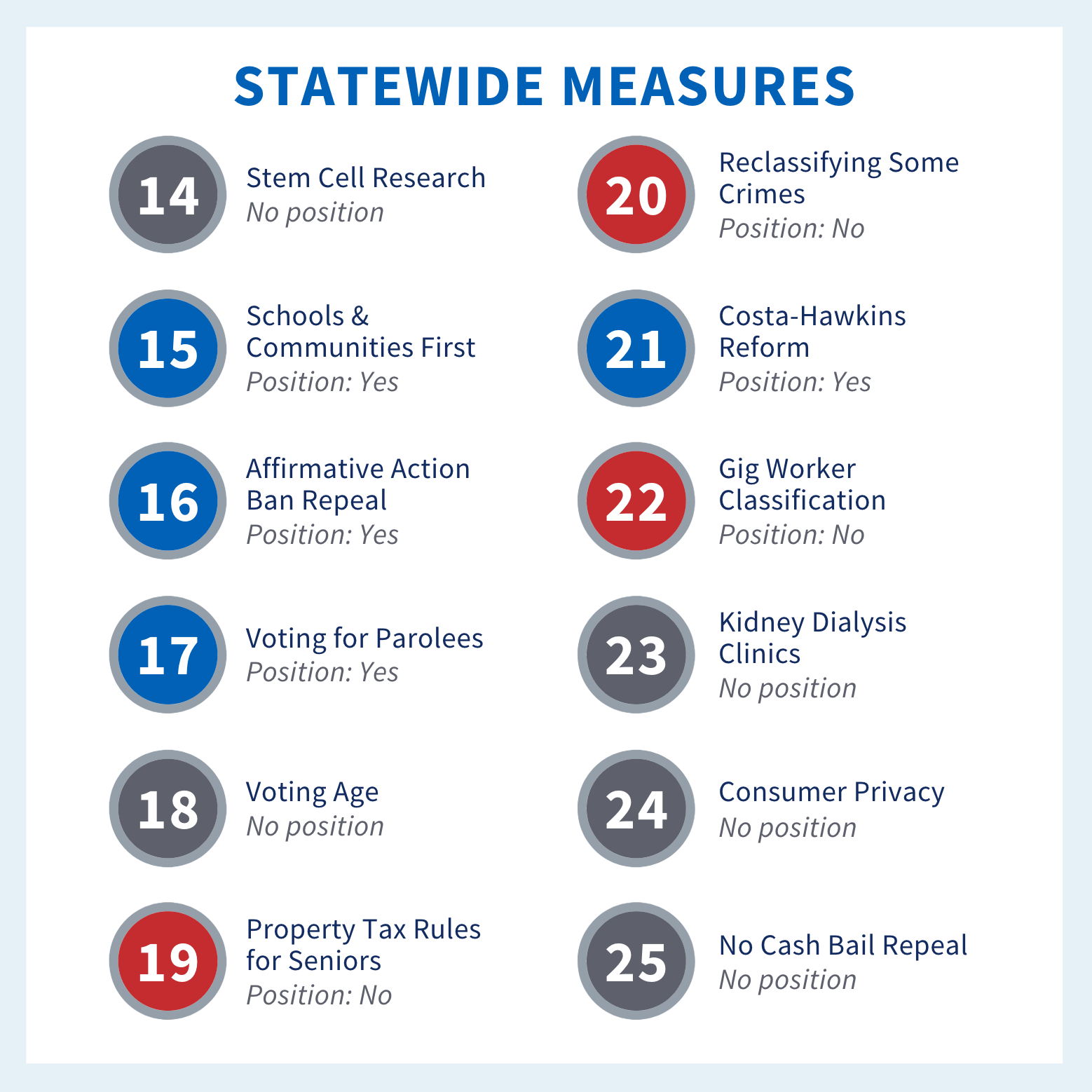

In California, policy change often happens on the ballot, and many of the ballot initiatives can be hard to understand. Our team has evaluated each of twelve statewide measures in California to provide clarity on what the measures do and, where they intersect with TechEquity’s advocacy platforms, make recommendations on how our community should vote.

Prop 14 would authorize a $5.5 billion bond to replenish funding for the publicly run California Institute of Regenerative Medicine, which conducts stem cell research.

What is Proposition 14?

Back in 2004, voters created the California Institute of Regenerative Medicine in response to federal restrictions on stem cell research. The Institute has nearly exhausted its initial funding, so Prop 14 would allow the Institute to refill its coffers. The state would sell $5.5 billion in bonds to investors and pay back the money with interest over 30 years. The Institute would use the funding to continue stem cell research and development of treatments for a number of diseases including Alzheimer’s and Parkinson’s disease.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Prop 15 would reclaim an estimated $11.5 billion annually for public schools and local community services by closing a tax loophole exploited by commercial property-owners.

What is Proposition 15?

Prop 15, put forth by the Schools and Communities First coalition, would raise an estimated $11.5 billion per year by closing a commercial property tax loophole that mainly benefits large corporate property-owners. The revenue raised by the measure would increase funding for public schools and community services. The measure would tax commercial property at its current market value, moving California in line with most states. Residential properties, as well as agricultural properties and commercial properties worth less than $3 million, would not see any change to their property taxes.

Position: YES! TechEquity has been a longtime supporter and member of the Schools and Communities First coalition and we are proud to now endorse Prop 15. It’s imperative that we reclaim the $11.5 billion we give away every year to commercial property owners. That money will help our cities and counties weather the economic downturn from the pandemic, boost school funding, build affordable housing, provide homes and services for our unhoused neighbors, and improve a long list of other community services. Ending the commercial tax break will encourage housing production by removing incentives for property owners to sit on their land; it will also wean local governments off regressive taxes that unfairly burden lower-income residents.

Prop 16 repeals the state’s ban on affirmative action and allows for consideration of race, ethnicity, gender, and other identities in college admissions, public contracting, and public employment.

What is Proposition 16?

Prop 16 would once again allow equal opportunity programs like affirmative action in California by repealing the ban put in place by Proposition 209. That 1996 measure banned state and local governments from discriminating or giving preferential treatment on the basis of race, ethnicity, national origin, color, or sex. The prohibition on preferential treatment meant that public institutions could no longer use affirmative action, which is the practice of specifically considering those identities when making employment, college admission, and contracting decisions. Prop 16 would allow state and local governments along with the University of California and Cal State systems to take those factors into consideration, but it would not institute quotas on the basis of race, gender, or other identities.

Position: YES! We at TechEquity recognize that there is a several hundred year-long history of ongoing abuse and discrimination on the basis of race, ethnicity, nation of origin, color, and gender in our state and country. To overcome the present-day disparities caused by that history, California requires affirmative programs that take into consideration the effects of race, ethnicity, gender, and other identities. Prop 16 will improve the diversity of our college student bodies, bring fairness to state contracting, and allow for efforts to build a more inclusive public workforce. By expanding access to the UC system, more marginalized people will hold highly-valued degrees. We expect that will play a part in improving racial equity in tech—while recognizing that much more work is needed to broaden the image of the “ideal” job candidate.

Prop 17 allows people on parole to vote and run for public office.

What is Proposition 17?

Currently, people on parole cannot register to vote in California. This means they cannot participate in elections either as voters or candidates. Prop 17, placed on the ballot by the legislature, would change that by making it legal for people on parole to register to vote. If it passes, Prop 17 would add California to a list of 16 other states plus Washington D.C. that allow people on parole to vote.

Position: YES! Although criminal justice is not directly one of our issue areas, it has deep intersections with both housing and workforce & labor. We did not want to remain silent on this issue, so we consulted with organizations who specialize in criminal justice policy to make an endorsement on this measure. We’re happy for the opportunity to boost the voices of those dedicated advocates and urge a Yes vote on Prop 17!

Prop 18 allows 17-year-olds to vote in state primary and special elections if they will be 18 by the general election.

What is Proposition 18?

Currently, voters must be 18 years old at the time of the election to vote in local, state, and federal elections. Prop 18 will allow voters who will turn 18 by the time of the next general election to vote in the primary and special elections leading up to the general. The measure would also allow qualifying 17-year-olds to run for office because being registered to vote is required to stand as a candidate. The legislature placed Prop 18 on the ballot.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Prop 19 allows seniors, people with disabilities, and victims of natural disasters to transfer their property tax break to a new home anywhere in the state and requires inherited property to be used as a primary residence to keep its property tax break.

What is Proposition 19?

Proposition 19 is a complicated measure sponsored by the California Association of Realtors that makes two very unrelated changes to the way property taxes work for homes and local & state budgets. The first makes it easier for senior homeowners to move within California and keep their property tax breaks but would cost local governments over a billion dollars. The second would end a tax break for inherited property, which raises tax revenue for local governments. Analysts estimate that, overall, the measure will somewhat increase tax collection in the state, and that extra revenue will be used for fire protection. While the first two components largely offset each other’s budget impacts, there isn’t much additional policy rationale for combining them in one measure.

Position: No. There is no good reason to combine the two major provisions of the bill. The Realtors tried in 2018 to expand the portability of the residential property tax break and voters, correctly, rejected that proposal. Nothing has changed in the two years since to make it appropriate to revisit that proposal. We support the provision to limit tax breaks for inherited property. In a time when local governments are desperate to stabilize their tax revenues, it doesn’t make sense to continue giving a tax break to rental properties and second homes. At the same time, it doesn’t make sense to sacrifice those increased revenues in an effort to increase home sales and commissions for realtors.

Prop 20 rolls back earlier reforms by expanding the list of offenses that can be charged as felonies and giving parole boards more freedom to deny early release.

What is Proposition 20?

Over the past decade, California made a number of reforms that sought to reduce the number of incarcerated people in the state. The reforms converted some offenses previously charged as felonies to misdemeanors, made it easier for people incarcerated on non-serious, non-violent charges to be released on parole, and allowed for discretion when responding to probation and parole rule violations. Prop 20 would roll back a number of these reforms by again allowing some of the non-violent offenses to be charged as felonies, narrowing eligibility for early parole, and increasing penalties for those with multiple probation violations. Prop 20 was placed on the ballot by a group of police unions and conservative prosecutors.

Position: NO! Although criminal justice is not directly one of our issue areas, it has deep intersections with both housing and workforce & labor. We did not want to remain silent on this issue, so we consulted with organizations who specialize in criminal justice policy to make an endorsement on this measure. We’re happy for the opportunity to boost the voices of those dedicated advocates and urge a No vote on Prop 20!

Prop 21 allows cities to enact rent control policies with at least a 15-year exemption for new construction and vacancy control that allows rents to rise at least 15% between tenancies.

What is Proposition 21?

Prop 21 would reform the Costa-Hawkins Act, a state law that limits the rent control laws that local governments can enact. The ballot measure would change the exemption for new apartment buildings to a rolling window of at least 15 years. Cities would not be allowed to impose rent control on a building for at least the first 15 years after its construction, but then would be free to set rent control rules on the building. Prop 21 would also allow cities to regulate the rent increases for new tenants, a policy known as vacancy control. Under the measure, cities must allow landlords to raise the rent for a new tenant to at least 15% more than what the previous tenant paid. The measure would remove Costa-Hawkins’ exemption of single-family homes and condos if they are owned by a corporate entity or by a person who owns more than two properties.

Position: Yes. Prop 21 is tricky, but we believe that the positives of the measure outweigh the possible negative effects. Setting a minimum 15-year exemption for new construction helps mitigate some of the concerns about slowing housing production. Ensuring that vacancy control systems allow for some rent increases is also a good way to prevent cynical cities from using overly strict rent control laws to limit new housing production and encourage the elimination of rental housing in their cities. We also appreciate that individual single-family homeowners are exempted from rent control by this measure because very small landlords are particularly sensitive to taking their homes off the market with increased regulation, but larger landlords should not get to piggyback on this provision just because they’re renting out a single-family home. We still have concerns that a maximally restrictive local rent control policy could have an overly negative effect on housing supply. When considering city rent control plans made possible by Prop 21, we’ll be looking to make sure the policy balances the need to protect existing tenants against building enough new housing to create a long-term solution to the housing crisis.

Prop 22 would grant app-based ride-hailing and delivery companies a special exemption from a state law requiring them to treat drivers as employees instead of independent contractors.

What is Proposition 22?

Prop 22, written by Uber, Lyft, DoorDash, Postmates (a corporate partner of TechEquity), and Instacart, carves out an exemption from recently-passed state law AB 5 and allows them to legally classify drivers as independent contractors. This means drivers would not get many of the benefits and protections that employment status provides. Drivers would lose access to benefits like overtime pay, paid sick leave, personal protective equipment during the pandemic, and standard unemployment insurance that they would receive as employees. They would also not be allowed to form a union. Prop 22 does mandate certain pay, reimbursement, and benefit standards for drivers, but there are loopholes in these standards which erode their value, potentially to sub-minimum wage levels.

Position: No. We oppose Prop 22 because it would weaken driver pay, benefits, and protections compared to what they would receive under current law. AB 5, as courts have recently found, almost certainly makes drivers employees and eligible to receive minimum wage and a host of other employment benefits. While employee status alone is not enough to guarantee a good job, Prop 22 would hinder job quality for these workers. And when we consider the question of who should bear the risk of operating these companies, there is no question in our mind that it should be the large investor-backed corporations and not the drivers who are just trying to make ends meet.

Prop 23 would require dialysis clinics to have a doctor on-site, report infection data to the state, and ban discrimination based on insurance type.

What is Proposition 23?

A prominent healthcare workers union placed Prop 23 on the ballot to increase regulations at kidney dialysis clinics in the state. The measure would require the clinics to have a doctor on-site, report infections to the state Department of Public Health, get approval from the state before closing a clinic, and ban clinics from refusing to provide care because of the type of insurance a patient has. Prop 23 follows an unsuccessful 2018 measure that would have limited dialysis clinics’ profits.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Prop 24 would replace the recently passed California Consumer Privacy Act with another data privacy law that has split privacy and consumer advocates.

What is Proposition 24?

In 2018, the state legislature passed the California Consumer Privacy Act (CCPA), with the goal of overhauling protections for personal data privacy. One of the main advocates for the law, billionaire Alastair Mactaggart felt that the CCPA did not go far enough and placed Prop 24 on the ballot to replace the recently passed law. Prop 24 would allow people to require businesses to limit the use of personal data like location, race/ethnicity, religion, and health condition. It would also ban businesses from keeping personal data longer than is necessary for business purposes. The measure would create a new state agency to enforce the privacy protections and allow the state to issue fines of up to $7,500 for violations. Prop 24 would exempt smaller businesses from its requirements and only apply the regulations to businesses that buy or sell data for more than 100,000 people per year.

Position: No Position. This measure does not have a close nexus to our issue areas or mission.

Prop 25 would confirm a plan passed by the legislature which ends cash bail for pre-trial incarceration decisions and instead uses judges’ discretion.

What is Proposition 25?

In 2018, the state legislature passed a plan to eliminate cash bail. The plan would instead require judges to use their discretion, assisted by an algorithmic risk assessment when determining if a person should be incarcerated prior to trial. Prop 25 was placed on the ballot by the bail bonds industry and requires voters to confirm the legislature’s plan. Criminal justice advocates are split on Prop 25. While the advocates criticize the cash bail system as being biased against those with lower-incomes, some are concerned that the legislature’s replacement could result in more people held before trial and introduce biases through the risk assessment tool and judges’ discretion.

Position: No Position. Although criminal justice is not directly one of our issue areas, it has deep intersections with both housing and workforce & labor. We did not want to remain silent on this issue, so we consulted with organizations who specialize in criminal justice policy on this measure. We learned that the criminal justice advocacy community is split on this measure, so we are not taking a position on Prop 25.